In other words creditors could go after your home car bank account investments etc to pay the judgment and individuals could even be held personally responsible for any fraudulent actions of the LLC. However the concept of piercing the veil in other forms of Texas.

The seven different theories are as follows.

Piercing the corporate veil in texas. B common directors and officers between parent and subsidiary. 1 the corporation is the alter ego of its owners andor shareholders. Strategies Regarding Corporate Veil Piercing and Alter Ego Doctrine July 31 2018 12 Opus E LLC Delaware LLC is developer and seller of commercial real estate projects.

The intersection of TUFTA and veil piercing concepts in Texas is discussed at greater length here. Piercing the Corporate Veil A short discussion cannot do justice to the developments in the area of corporate veil piercing in Texas over the last 30 years. Another emerging concept is that many federal statutes and probably some state statutes and common law rules in Texas impose liability on managers for participating in conduct or failing to take certain actions eg.

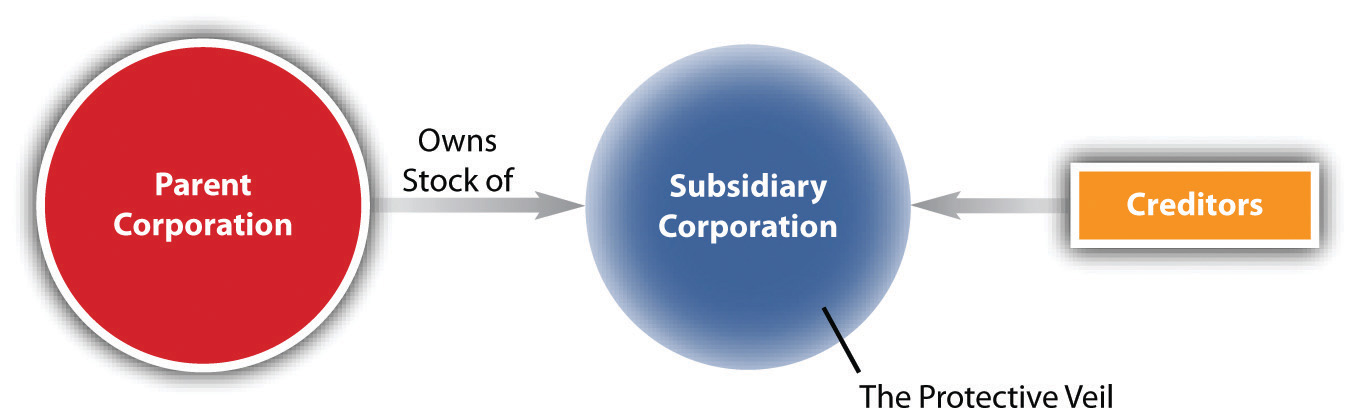

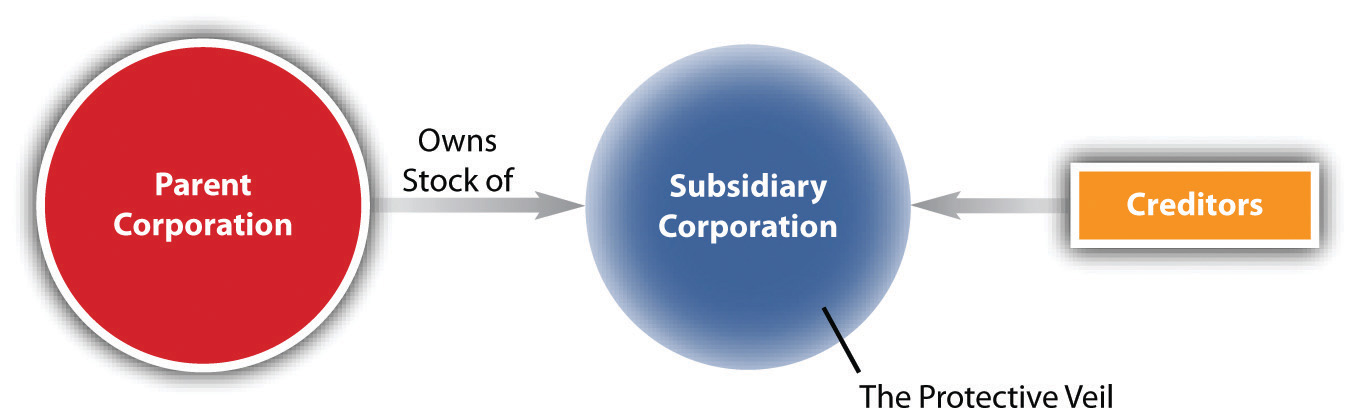

When a court decides to pierce a corporations veil they are lifting that veil of limited liability and the single-person LLC can be held personally liable for the businesss debts. 2 the corporation is used for illegal purposes. The Actual Fraud Rule.

The theory of piercing the corporate veil PCV is well-developed by both the courts and statutes in Texas. The default rule in Texas is No veil-piercing which preserves the separation of the corporate entity and individual owners. 2 the corporation is used for illegal purposes.

In Texas In re JNS Aviation LLC 2007 is a leading case. Alter Ego Theory Traditionally most veil-piercing cases were premised on the alter ego theory. 2004 concluding that under Alabama law it is possible to pierce the veil of.

Though Texas Courts previously provided Plaintiffs a number of ways to hold owners of business entities liable a Texas Supreme Court decision in 1986 Castleberry resulted in the Texas legislature limiting Plaintiffs abilities to hold corporate owners liable. The author extends special thanks to Sarah Dotzel who assisted in preparing this article. And 3 the corporation is used a sham to perpetrate a fraud 388 F3d at 143.

Legislative sessions veil piercing is now addressed by statute in Texas in such a way that piercing the corporate veil to impose personal liability for a contractual or contractually-related obligation of a corporation is quite difficult. The post-Castleberry amendments to Article 221 of the TBCA provided that a shareholder or affiliate. Or 3 the corporation is used as a sham to perpetrate a fraud.

Only when corporations are used as alter-egos or shams for fraudulent activities is veil-piercing feasible. A common stock ownership between parent and subsidiary. There are seven theories generally accepted for piercing of the corporate veil and because each are separate and distinct ways of disregarding the corporate form the Texas collections attorney must specifically plead each theory or they will be considered waived.

Under Texas law to pierce to corporate veil and hold a shareholder or owner of a corporation personally liable for a contractual obligation the person bringing the claim must prove 1 that the shareholder caused the corporation to be used for the purpose of perpetuating and did perpetuate an actual fraud on the claimant and 2 that the fraud was perpetrated for the direct. Piercing the corporate veil simply means holding the directors officers shareholders or members liable for the LLCs debts or other misconduct. 2d 1266 1268 MD.

Separate holding and operating companies for different geographical areas. The Rimade court stated Under Texas law there are three broad categories in which a court may pierce the corporate veil. Part of a large network of real estate companies aka.

However a brief summary is provided below. The Texas Supreme Court has described this basis for piercing the corporate veil as follows. Not paying withholding taxes.

Courts can do this in the following situations. A company engages in fraudulent or wrongful actions such as making business deals knowing that the business cannot pay its invoices. Historically Texas law permitted piercing the corporate veil when 1 the corporation is the alter ego of its owners andor shareholders.

When a plaintiff in Texas wants to pierce the corporate veil in order to impose liability upon a parent corporation for the obligations of a subsidiary the primary factors that Texas courts will look to include the following. Noting that Texas permits application of principles of piercing the corporate veil and alter ego to pierce the liability shield of LLCs. While piercing the corporate veil is difficult regardless of the timing knowing the strategic advantages of veil piercing at the pre-judgment stage versus the post-judgment stage could increase a plaintiffs probability of collecting its judgment.

The court found that the corporate veil could be pierced when any of the asserted veil-piercing strands are met. Article 221 of the Texas Business Corporation Act TBCA specifically addresses corporate veil pierc-ing. A court will pierce the corporate veil when it finds that the corporation is an agent of its shareholder and will hold the principal vicariously liable due to the respondeat superior doctrine.

Olhoss Trading Co LLC 321 F. This is known as piercing the corporate veil.

Pdf The Doctrine Of Piercing The Corporate Veil Its Legal And Judicial Recognition In Ethiopia

The Daily Filibuster Piercing The Corporate Veil

Piercing Corporate Veil Under Indonesian Law

A Brief History Of Piercing The Corporate Veil Rossdale Cle Piercing The Corporate Veil Pdf4pro

Pdf Piercing The Corporate Veil To Impose Criminal Liability On Corporations K B Ahmad Academia Edu

18 Compare Us Reverse Piercing Of The Corporate Veil A Straightforward Path To Justice By Nicholas Allen Piercing The Corporate Veil Corporations

A Brief History Of Piercing The Corporate Veil Rossdale Cle Piercing The Corporate Veil Pdf4pro

Asset Protection Veil Piercing Waldron Schneider

Liability Of Corporate Shareholders Piercing The Corporate Veil

Pdf Piercing The Corporate Veil Doctrine In Poland A Comparative Perspective

A Brief History Of Piercing The Corporate Veil Rossdale Cle Piercing The Corporate Veil Pdf4pro

The Doctrine Of Piercing The Corporate Veil Its Legal

Pdf Lifting The Veil On Piercing The Veil

Piercing The Corporate Veil In Texas Silberman Law Firm Pllc

50 Of Biz Owners Lose This Lawsuit Avoid It In 3 Steps

Corporation General Characteristics And Formation

Pdf Company Law Ll M What Is Meant By The Corporate Veil Feleena Grosvenor Academia Edu

Piercing The Corporate Veil Your Personal Assets Could Be At Risk Proadvocate Group Pma